×

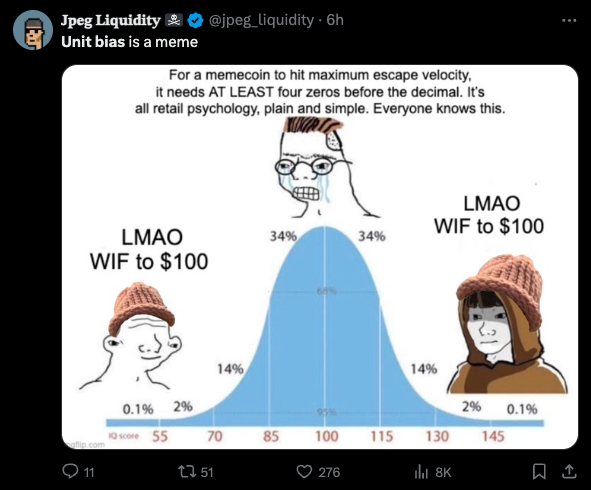

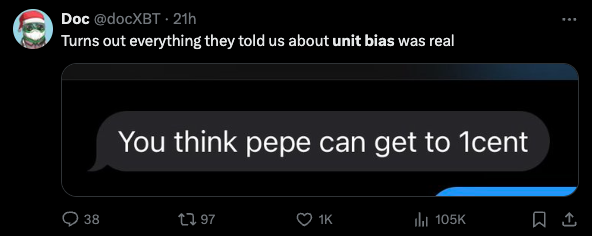

What the fuck is unit bias?

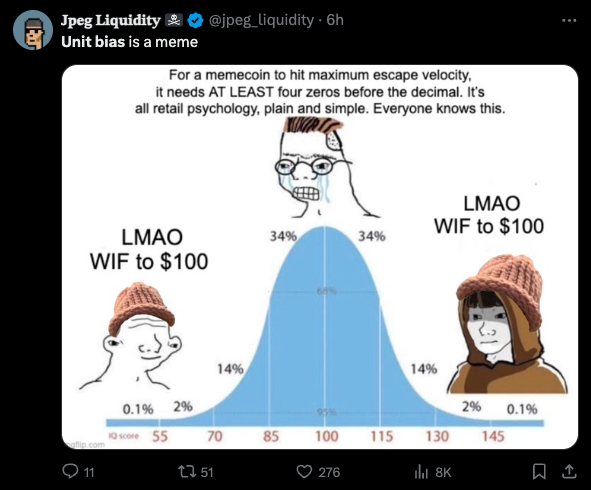

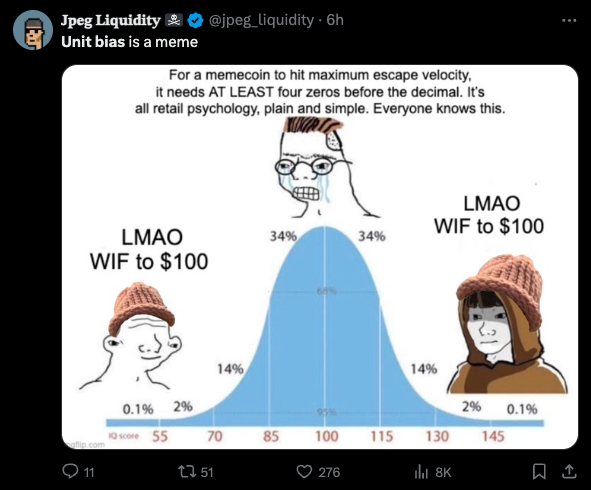

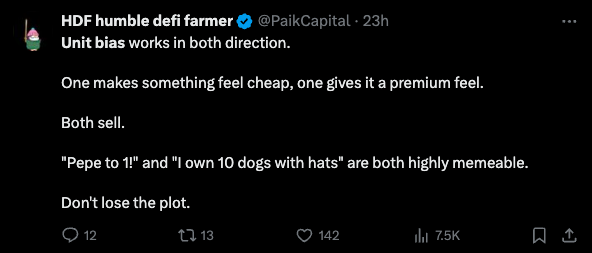

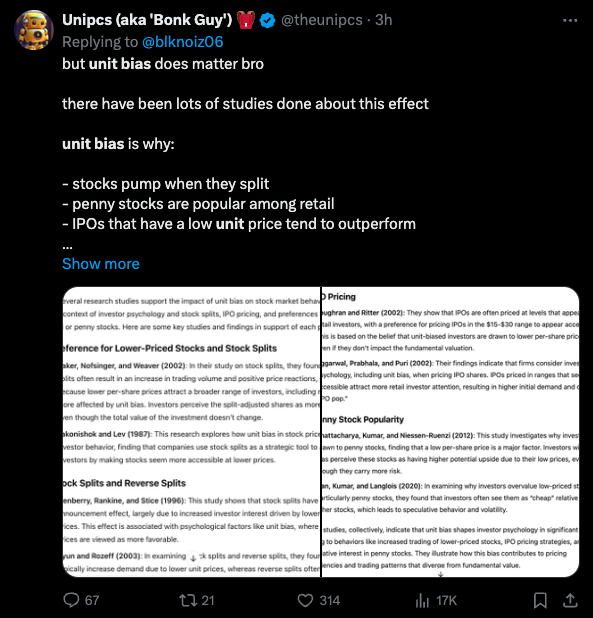

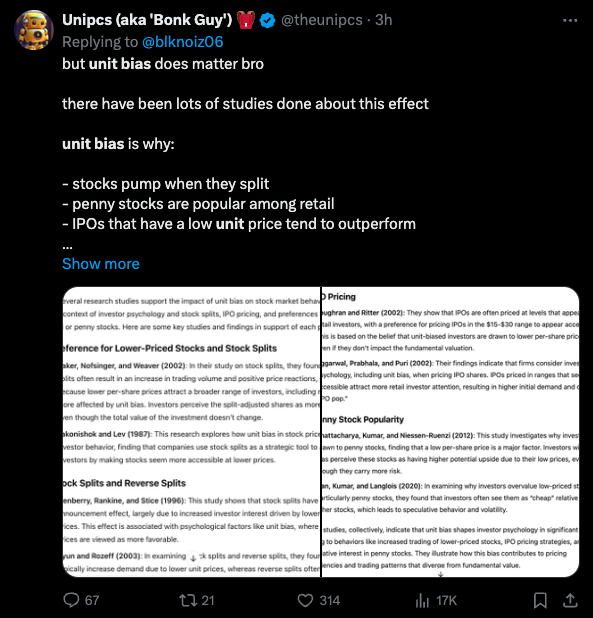

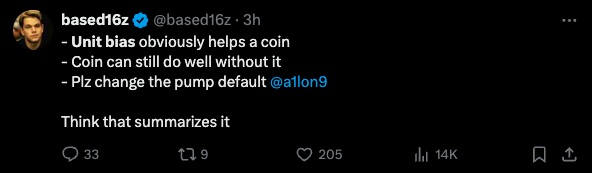

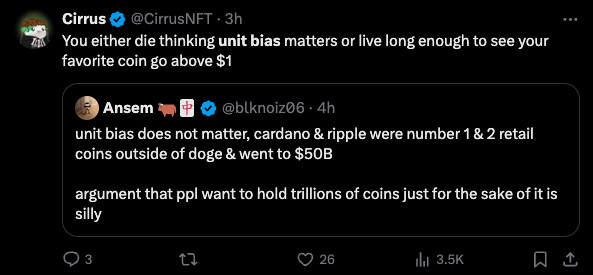

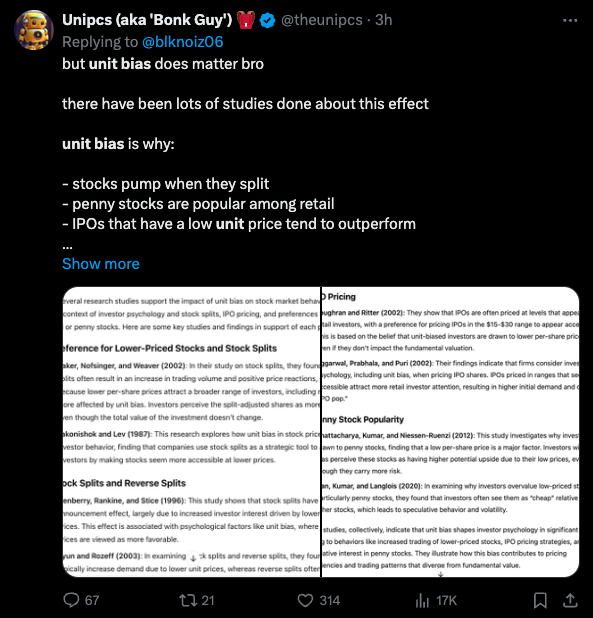

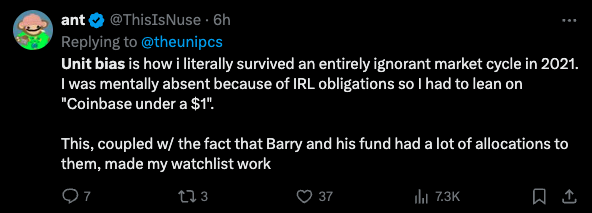

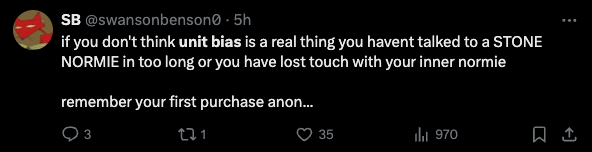

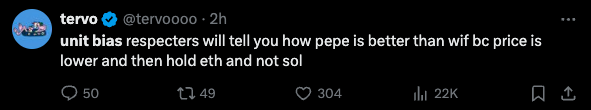

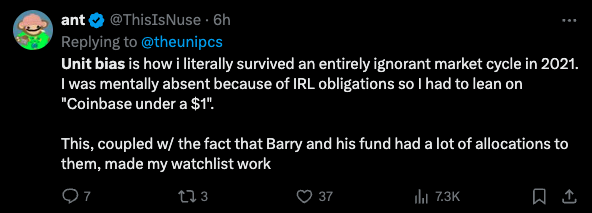

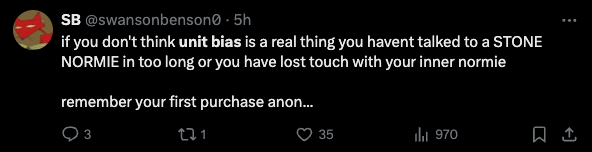

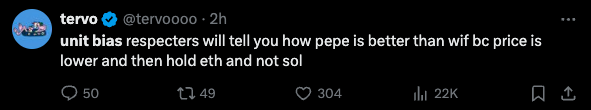

Unit bias is a cognitive bias that affects how people perceive and value assets based on their nominal price rather than their intrinsic value or market capitalization. In simpler terms, unit bias is the tendency for investors to prefer owning whole units of lower-priced assets over fractional amounts of higher-priced ones, even if the higher-priced assets have better fundamentals or growth potential.

Here's a clear example to illustrate unit bias. Imagine two cryptocurrencies:

- Coin A, priced at $1 per coin with a total supply of 1 billion coins

- Coin B, priced at $1,000 per coin with a total supply of 1 million coins

Both coins have the same market capitalization of $1 billion (price × total supply). However, an investor influenced by unit bias might find Coin A more attractive simply because they can afford to own more whole units of it, even though Coin B might have superior technology, adoption, or growth potential.

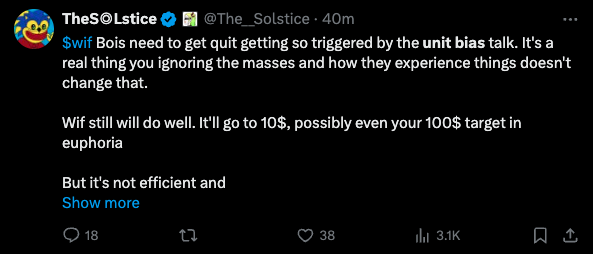

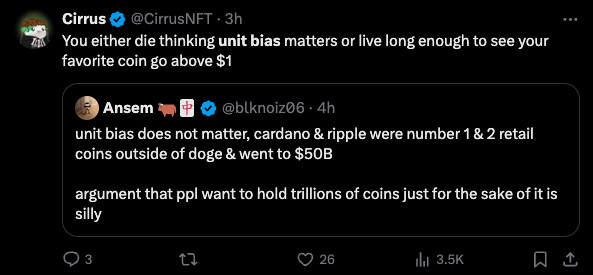

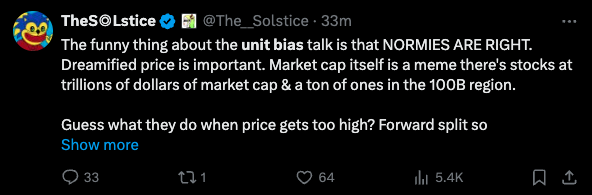

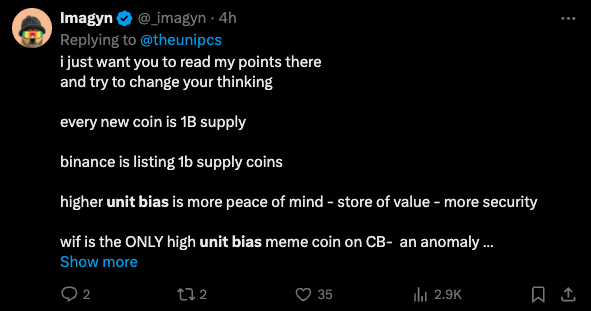

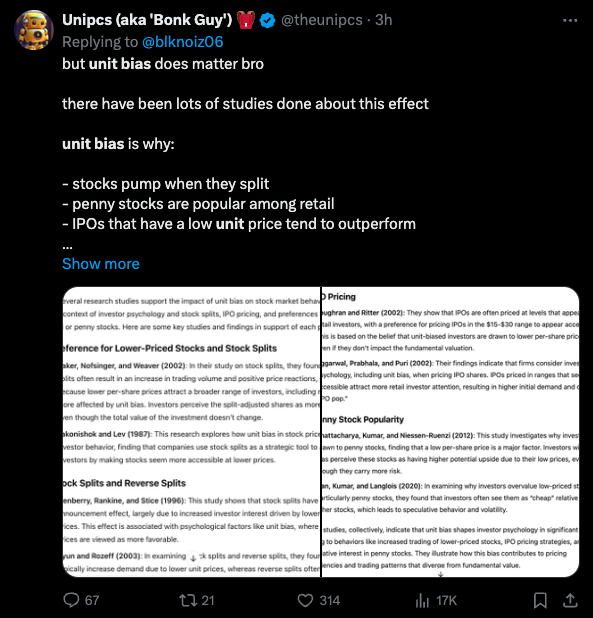

Unit bias can have significant consequences in the cryptocurrency market:

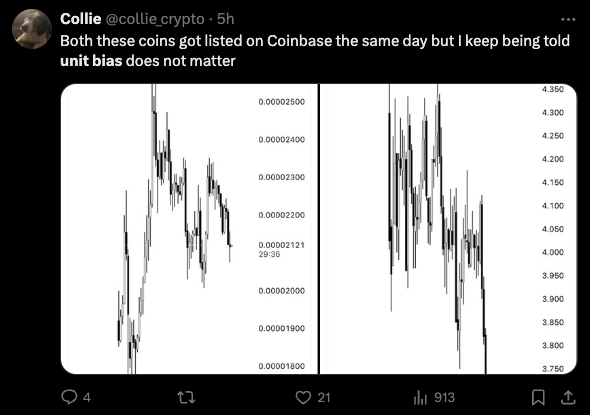

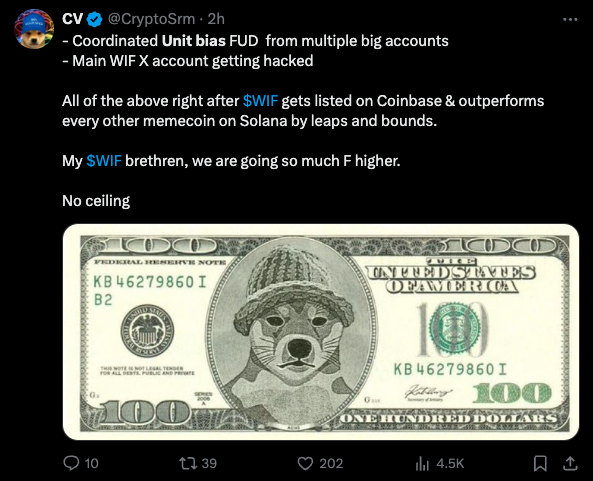

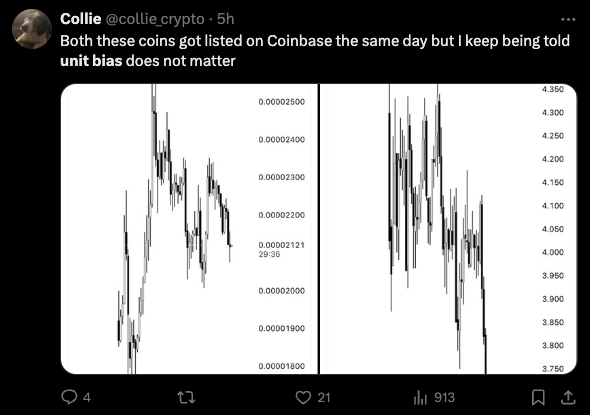

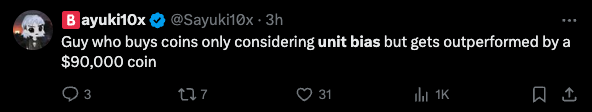

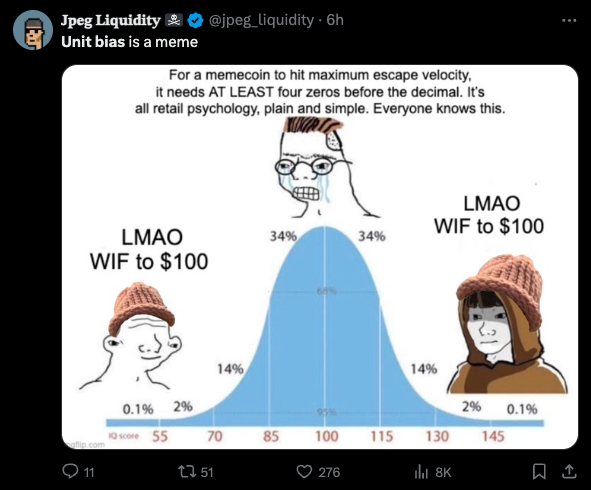

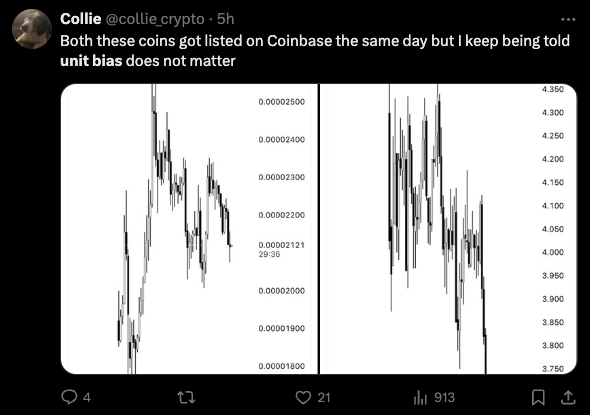

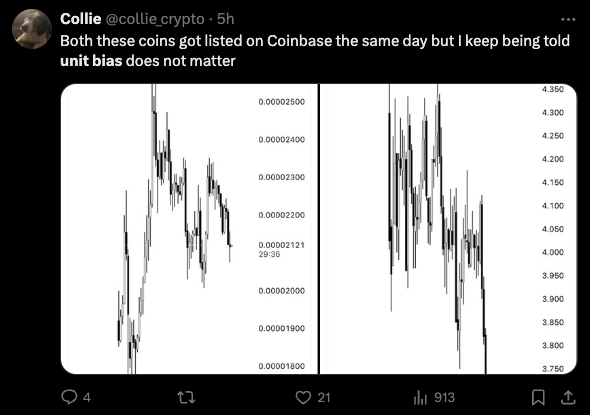

- Overvaluation of low-priced coins: Increased demand for cheaper coins can lead to speculative bubbles and overvaluation relative to their fundamentals.

- Undervaluation of high-priced assets: Higher-priced cryptocurrencies with strong fundamentals may be overlooked or undervalued due to unit bias.

- Irrational market behavior: Unit bias can contribute to market inefficiencies and hinder the accurate pricing of assets based on their intrinsic value.

To make well-informed investment decisions, it's crucial to recognize and overcome unit bias. By focusing on factors beyond nominal price, investors can better assess the true value and potential of cryptocurrencies, leading to more rational and potentially profitable investment choices.